All Categories

Featured

Nevertheless, these policies can be extra complicated contrasted to other sorts of life insurance policy, and they aren't necessarily right for each investor. Talking to a knowledgeable life insurance policy agent or broker can aid you decide if indexed global life insurance is a great fit for you. Investopedia does not supply tax, investment, or economic services and suggestions.

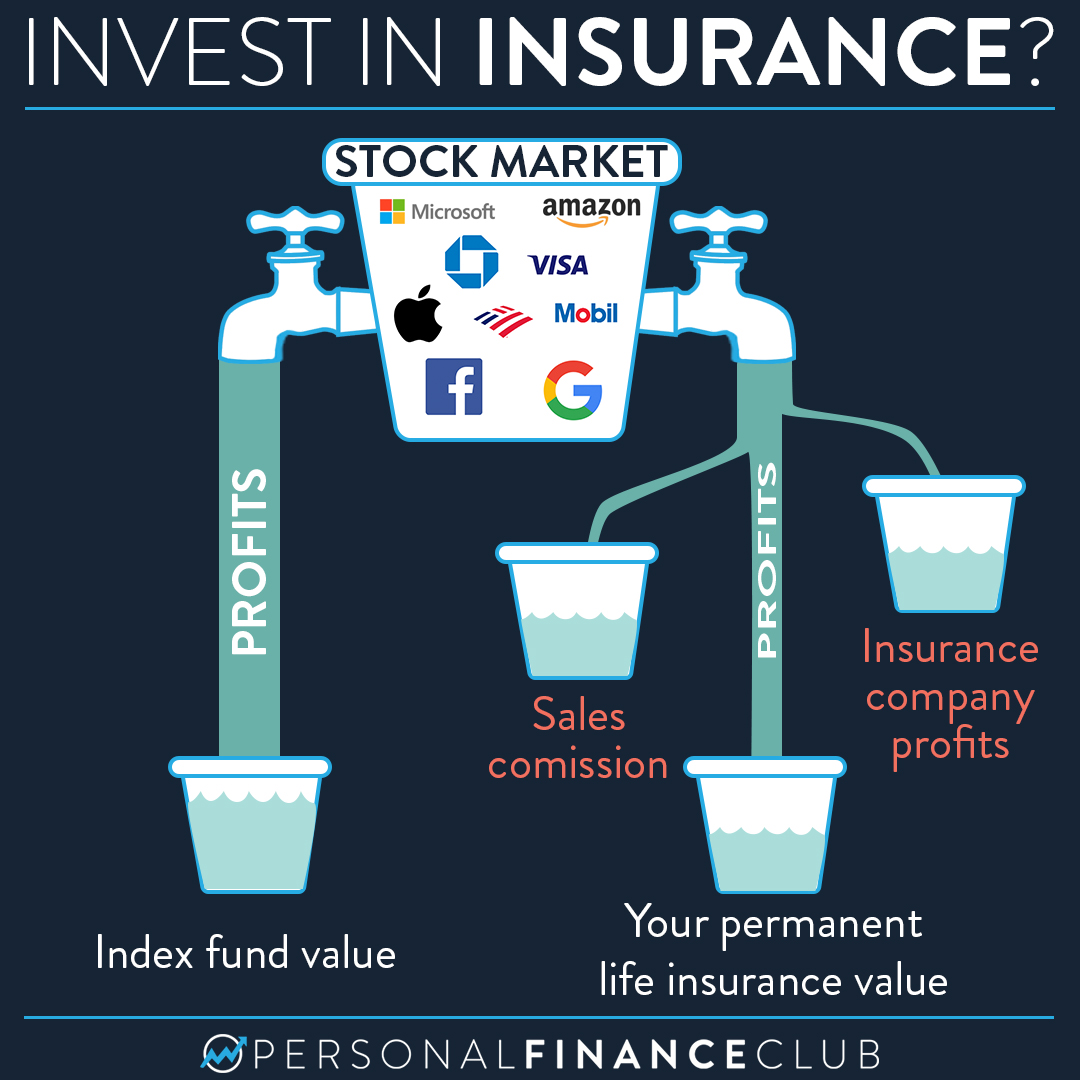

A 401(k) is a far better retirement financial investment than an LIRP for the majority of people due to the LIRP's high premiums and a reduced roi. You shouldn't add life insurance coverage - IUL vs Roth IRA: Which Retirement Strategy Should You Choose? to your retirement preparation up until you make the most of possible financial savings in a 401(k) plan or IRA. For some high-net-worth individuals, including a permanent life policy to their investment profile might make good sense.

Applied to $50,000 in savings, the charges above would amount to $285 per year in a 401(k) vs.

In the same veinExact same blood vessel could see might growth financial investment Development7,950 a year at 15.6% interest with rate of interest 401(k) compared to $1,500 per year at 3% interest, passion you 'd spend would certainlyInvest more on life insurance each insurance policy to have whole life coverage. IRA vs IUL: Which Investment Vehicle Works Best for Retirement?. For many individuals, getting permanent life insurance as component of a retired life plan is not a good idea.

Pros And Cons Of Indexed Universal Life (Iul) Vs 401(k)

Typical financial investment accounts typically offer greater returns and more versatility than entire life insurance policy, however whole life can provide a fairly low-risk supplement to these retirement financial savings techniques, as long as you're positive you can afford the premiums for the life time of the policy or in this instance, till retired life.

Latest Posts

Universal Life Insurance Phone Number

Best Universal Life Insurance Companies

Growth Life Insurance